Investing in Tata Motors is, in many ways, like embarking on a long and unpredictable journey. Just as a seasoned driver navigates various terrains, investors must remain alert to both the highs and lows of the stock market. Tata Motors’ stock has been known for its significant price fluctuations, making it an exhilarating adventure for those willing to ride out the volatility.

The key to successfully investing in Tata Motors lies in understanding its long-term potential while also keeping an eye on short-term market dynamics. Many investors are attracted to Tata Motors due to its leadership in the electric vehicle space, its diversified business portfolio, and its global footprint. However, like any stock, Tata Motors also comes with risks, particularly related to market competition, supply chain disruptions, and economic conditions that could affect demand.

In the short term, support and resistance levels provide valuable insights into price movements. For traders who are focused on short-term gains, these technical levels offer opportunities to buy low and sell high, or even to short the stock when resistance levels are strong.

However, long-term investors will be more focused on the bigger picture. They may be willing to endure short-term volatility if they believe in the company’s growth strategy and its ability to generate sustained returns over time. With Tata Motors’ aggressive push into the EV space and its commitment to innovation, the stock offers a compelling narrative for those who believe in the future of electric mobility and global expansion.

In terms of technical analysis, Tata Motors’ current price sits in a critical zone. Analysts highlight support levels around ₹950-940, which could act as a launching pad for the stock to regain momentum. On the other hand, resistance levels between ₹984 and ₹1,036 are seen as key hurdles to further upward movement. Investors and traders should keep an eye on these levels, as breaking through resistance could signal a bullish trend, while falling below support could suggest a period of consolidation or even a potential downturn.

For traders who focus on technical patterns, there are several strategies to consider. One common approach is to buy near support levels and sell or short near resistance. For those looking to capture more significant moves, a breakout strategy could be employed. This involves waiting for the stock to break through a key resistance level (such as ₹1,036) with strong volume, which could indicate the beginning of a new upward trend.

Swing traders may also look for patterns like double tops or bottoms, which can provide signals for trend reversals. Combining these strategies with indicators like moving averages, the relative strength index (RSI), and the moving average convergence divergence (MACD) can provide a more comprehensive view of the stock’s potential movements. Power up your investment journey with the Aulet Home Level 2 EV Charger and ensure your Tata Motors electric vehicle is always ready to hit the road with cutting-edge charging technology.

A Detailed Examination of Tata Motors’ Share Price and Future Prospects

Understanding Tata Motors’ stock requires a thorough analysis of not just its technical levels, but also its financial performance, market position, and future growth prospects. The company’s current share price dynamics offer valuable insights into its potential, especially when combined with an understanding of key financial metrics.

Current Share Price Dynamics and Recent Performance

As of September 25, 2024, Tata Motors’ share price stands at ₹963.60, reflecting a slight dip of 1.40% over the previous 24 hours. This recent volatility highlights the stock’s sensitivity to market conditions and external factors such as economic news, industry developments, and global events.

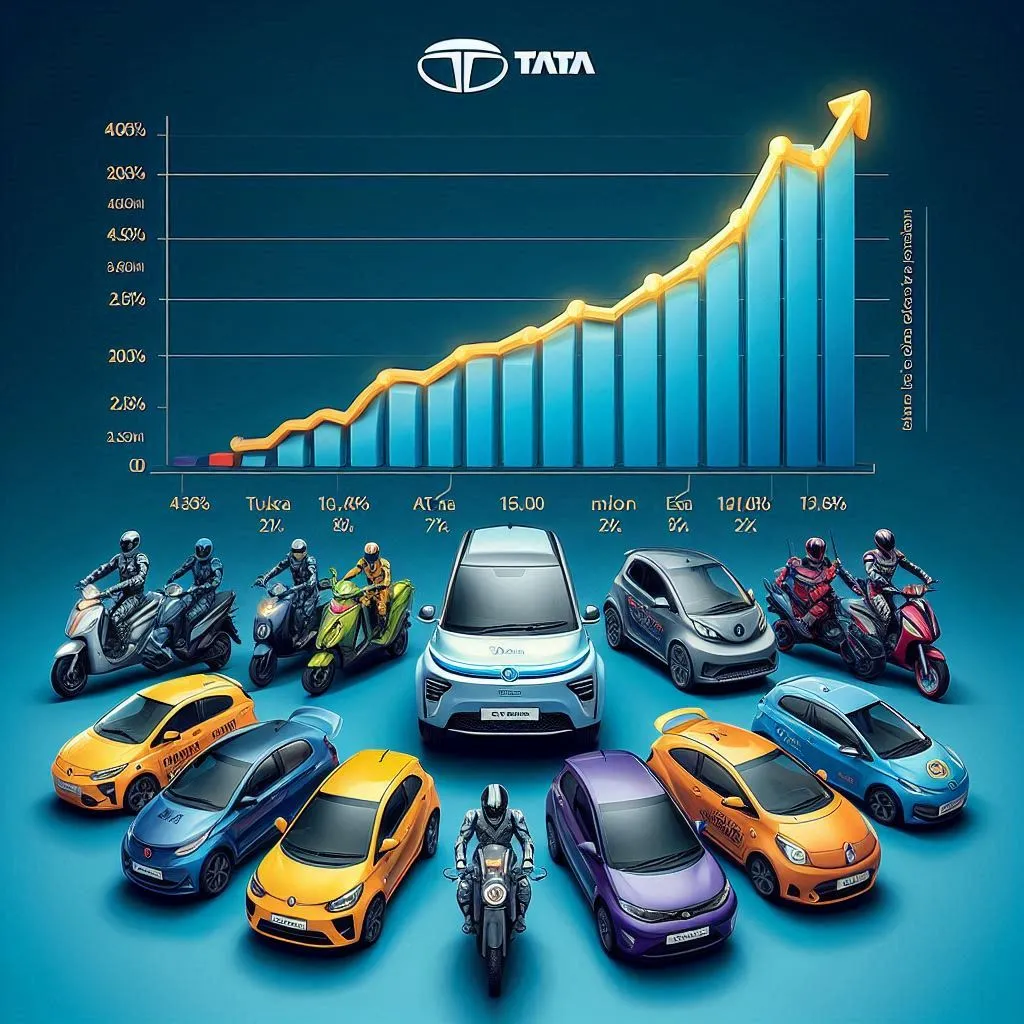

Tata Motors’ 52-week high of ₹1,179.00 and 52-week low of ₹608.30 offer further context to its performance over the past year. While the current share price is approximately 18.27% below its peak, it remains well above its lowest point, underscoring the stock’s ability to rebound from significant downturns.

Zooming out, the stock has gained approximately 51.45% over the past year, signaling strong investor confidence. Despite a recent dip of around 11% in the past month, the stock is still up 23.61% since the beginning of the year, outperforming the BSE Sensex, which has risen 17.49% in the same period. This strong performance reflects the company’s robust fundamentals, strategic initiatives, and market leadership in key areas such as electric vehicles.

Key Financial Metrics: A Glimpse Under the Hood

Tata Motors’ financial performance further supports its potential as an investment. With a market capitalization of approximately ₹3,58,886 crore, the company commands a significant presence in both the Indian and global automotive markets. Its trailing twelve-month price-to-earnings (P/E) ratio of 10.63 suggests that the stock is reasonably priced relative to its earnings, making it an attractive option for value investors.

In addition to its P/E ratio, Tata Motors offers a dividend yield of 1.30%, providing investors with a modest return on their investment through regular dividend payments. While the dividend yield may not be as high as some other companies in the automotive industry, it does offer a tangible reward for shareholders, particularly those focused on income generation.

Factors at Play: What Drives the Tata Motors Stock Price?

Several factors influence Tata Motors’ share price, ranging from its global presence and manufacturing footprint to industry dynamics and economic conditions. The company operates manufacturing plants in key markets such as India, Argentina, South Africa, the UK, and Thailand. Additionally, its R&D centers in India, South Korea, the UK, and Spain reflect a commitment to innovation and staying ahead of industry trends.

The automotive industry is fiercely competitive, with both traditional automakers and new players vying for market share. As the EV market grows, Tata Motors faces increasing competition from companies like Tesla, Nio, and other established automakers making their own forays into electric mobility. Maintaining a competitive edge will require continuous innovation and strategic decision-making.

Raw material prices also play a crucial role in determining Tata Motors’ profitability. Fluctuations in the prices of steel, aluminum, and other essential components can significantly impact the company’s production costs and, in turn, its profit margins. As global supply chains continue to face challenges, managing these costs will be key to sustaining profitability.

Future Outlook and Growth Drivers: Is the Road Ahead Smooth or Bumpy?

Looking ahead, Tata Motors has several growth drivers that could propel its stock higher. One of the most significant is its expansion into emerging markets, particularly in Asia and Africa. These regions offer tremendous growth potential due to their growing middle classes, increasing disposable incomes, and rising demand for automobiles.

Tata Motors is also well-positioned to capitalize on the global shift toward electric vehicles. The company has already established a strong presence in the EV market, particularly in India, where it leads the segment. As more consumers around the world adopt electric vehicles, Tata Motors’ EV offerings could become a major driver of revenue growth.

Technological advancements in areas such as autonomous driving, connected cars, and shared mobility solutions also offer significant opportunities. The company’s ability to innovate and embrace these technologies will be critical to its long-term success. Stay ahead in the electric vehicle race with the Grizzl -E 48A Ultimate Fast Charger—perfect for those who value speed and reliability in their charging solutions.

On the financial side, Tata Motors must continue to manage its debt and improve profitability to sustain growth. Strategies to optimize operations, reduce costs, and improve efficiency will be key to achieving these goals. Investors will be watching closely to see how the company manages these challenges while pursuing its growth ambitions.

Conclusion

Is Tata Motors the Right Vehicle for Your Portfolio?

In conclusion, Tata Motors represents a compelling investment opportunity, but not without its risks. The company has demonstrated strong growth potential, particularly in the EV space, and has a well-established global presence. Its strategic initiatives, such as expanding into emerging markets and investing in advanced technologies, position it well for future success.

However, like any investment, Tata Motors comes with its share of uncertainties. Market volatility, economic conditions, and competitive pressures can all impact the stock’s performance. Investors need to weigh these risks against the company’s potential for long-term growth.

For those willing to navigate the twists and turns, Tata Motors could offer significant rewards. By staying informed, conducting thorough research, and considering both technical and fundamental analysis, investors can make more informed decisions about whether Tata Motors is the right vehicle for their portfolio.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investors should conduct their own research and consult with a financial advisor before making any investment decisions.

Comments (4)

How Adult Tricycles Help with Balance and Stability - MovingEnginessays:

September 26, 2024 at 9:21 pm[…] or returning after a long break. This increased confidence can translate into a more relaxed and enjoyable riding […]

Essential Guide to Dirt Bike Safety: Preventing Mechanical Failures and Riding Mistakessays:

September 29, 2024 at 12:22 pm[…] integrity of their machines. Understanding common mechanical failures is crucial for a safe and enjoyable riding experience. One of the prevalent issues riders’ faces is clutch failure. A malfunctioning […]

Rev Your Engines: The Best Motorcycle Games for Racing Enthusiastssays:

September 29, 2024 at 11:04 pm[…] physics can significantly enhance the overall gameplay experience, allowing enthusiasts to enjoy a virtual ride that feels almost […]

custom motorcycles for salesays:

November 17, 2024 at 5:09 am[…] They are designed for long-distance travel and leisurely rides, making them suitable for those who enjoy extensive journeys on the open road. Cruisers offer a classic American aesthetic, attracting riders who appreciate […]